Introducing the Tree of Web3 Wisdom

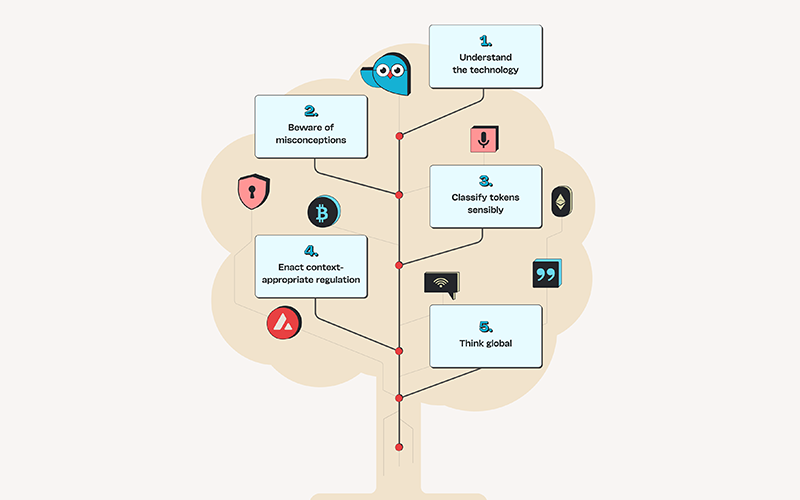

Introducing the Tree of Web3 Wisdom - 5 branches to guide policymaker thinking

The world of Web3 is rapidly evolving, while policymakers keep up with the latest developments to enact effective, sensible regulation that nurtures important technologies and protects consumers.

This is a global phenomenon. Japan continues to update its first-in-the-world comprehensive cryptoasset regulation; Singapore regularly iterates on its regulatory regime, as does South Korea and many small Asian jurisdictions. The EU is on the cusp of implementing its Markets in Crypto-Assets Regulation (MiCA), while various US regulatory agencies continue the work assigned to them in the President’s Executive Order from March 2022. The US Congress is also hard at work with hearings and draft bills.

Against this backdrop, the Tree of Web3 Wisdom provides a helpful framework for understanding the key aspects of Web3 technology and which first principles are important for regulating it. Let's explore the five branches of the Tree of Web3 Wisdom and their implications for policymakers.

The first branch of the tree is to understand the technology. Before regulating Web3, it's essential to have a deep understanding of blockchain technology. Blockchain allows for digital ownership and transfer of value across the internet, with enhanced security, transparency, auditability, programmability, and scale. It also enables users to program on these databases to create applications that are part of a larger tech stack for anything their creativity can imagine. This technology has the potential to empower communities, remove friction, verify credentials, and create new efficiencies in commerce. It's essential for policymakers to understand the capabilities of blockchains and the problems they solve to see the potential benefits and risks involved in its implementation.

The second branch of the tree is to beware of misconceptions. Blockchain technology isn't just about financial transactions. It's a new infrastructure for the internet, providing a decentralized system that promotes transparency and security by having no single point of failure, no single source of truth, and no single entity or authority with the power or obligation to change data or transactions. Crypto assets and blockchain are not synonymous. Blockchains facilitate crypto assets, but they also facilitate many other types of activities by allowing data integrity and digital uniqueness through tokenization. Crypto assets are a way to digitally represent something on a blockchain.

Decentralized systems promote transparency and security by having no single point of failure, no single source of truth, and no single entity or authority with the power or obligation to change data or transactions. Decentralization does not necessarily mean "permissionless and public," and it is crucial to understand that blockchain technology can be permissioned and private too. DeFi is more than just trading financial instruments–it is an avenue to democratize commercial systems by using blockchains and smart contracts to replace traditional intermediaries with built-in trust mechanisms. NFTs are not just for collectibles and art with revenue streams. An NFT is a type of token that is digitally unique, allowing for more specialized representations regardless of the industry.

The third branch of the tree is to classify tokens sensibly. A token is a digital representation of something on a blockchain, such as an asset, item, or bundle of rights. Tokenization allows the item's ownership to be established and transferred globally on one or more blockchain networks. A sensible classification systemrecognizes the nature of a token based on the item or rights it represents, whether it's a physical item, intangible item, a type of service, or simply a native token integral to the functioning of a particular blockchain network. Treating all tokens as financial instruments or the trading of tokens as financial activity will unnecessarily limit their use in commerce, communications, entertainment, recreation, governance, and anywhere else establishing ownership. It's essential to classify tokens sensibly to understand their utilization, valuation, and legal classification and, therefore, their appropriate regulatory treatment.

The fourth branch of the tree is to enact context-appropriate regulation. Just like plants need specific care depending on their nature and location, blockchain and crypto require appropriate regulation based on their context. Responsible actors want sensible policies that incentivize growth and good behavior, punish bad actors, and regulate intermediaries. Appropriate laws and regulations traditionally have been determined according to the type of asset or technology and its context, i.e., how it is being used, by whom, and the associated risks. This same approach should apply to blockchains and tokenization, which are just a new way of establishing ownership and transferring value. It's important to note that innovative programs and features on a blockchain are run by autonomously-functioning code, and their role needs to be carefully considered when regulating. In enacting context-appropriate regulation, policymakers must also consider the impact of blockchain and crypto on individuals and society.

Finally, the fifth branch of the tree is to think global. This last branch of the Tree of Web3 Wisdom emphasizes the ongoing evolution of blockchain technology and the endless possibilities for its use in various fields. The potential applications of blockchain technology go beyond financial transactions and encompass a wide range of industries, such as healthcare, supply chain management, voting, and identity verification. Just like the internet, blockchains and crypto assets are global and require a coordinated regulatory approach based on certain "first principles," including disclosure, market integrity, disclosure, anti-fraud, privacy, and operational integrity.

As blockchain technology continues to mature and evolve, it will likely provide even more benefits, such as greater privacy, scalability, and interoperability. Quality builders, including developers, entrepreneurs, and investors, will play a crucial role in driving innovation and creating new and exciting ways to use blockchain technology. Just look at Lemonade Foundation, as one example. However, this ongoing innovation and growth also requires sensible regulation to strike a balance between fostering innovation and protecting consumers and the broader economy.

In conclusion, the Tree of Web3 Wisdom provides policymakers with five critical principles to guide their thinking when considering how to regulate blockchain, tokenization, and Web3. By understanding the technology, avoiding misconceptions, classifying tokens sensibly, enacting context-appropriate regulation, and thinking globally, policymakers can create a regulatory framework that fosters innovation while supporting safety and security for all stakeholders.

Read the Tree of Wisdom in full here.